Cars are flying off U.S. dealer lots at the fastest pace since 2005, and after a decade of flat wages, the workers who make them are getting a raise, too. If such gains precede broader pay bumps in the labor market, Federal Reserve policy makers could have more evidence that the wage pressure they so desperately want to see is starting to build.

Sales of U.S. cars and light trucks ran at an 18.12 million annualized rate in October, the highest level since 2005, according to data from Ward's Automotive Group. Driven by low borrowing costs and cheap gasoline, the auto industry is on track for its strongest full-year performance since 2000.

Workers at Ford Motor Co. and General Motors Co. just approved new contracts last week that include across-the-board raises, a path to senior-level pay for entry-level workers and ratification bonuses of up to $10,000. They join workers at Fiat Chrysler Automobiles NV, who reached a similar agreement in October.

While the new labor contracts cover only those more than 140,000 unionized employees at the so-called Big Three carmakers, they have the potential to lift pay standards for the nearly 1 million people who work in the U.S. auto industry and may also spur wage gains through the broader labor market, according to Joel Cutcher-Gershenfeld, a professor of labor and employment at the University of Illinois at Urbana-Champaign.

"The auto industry has been a bellwether for the economy," he said. "It is certainly the case that there will be wage pressure on the foreign transplants in the Midwest and the South based on the auto agreements."

The deals come after a decade without raises for senior workers and lower wages and benefits for new hires — part of union-backed concessions workers agreed to in 2007 to stem job losses, as both Chrysler and GM headed into government-sponsored bankruptcies in 2009.

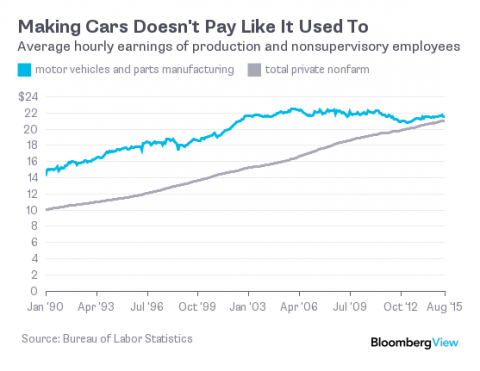

Since those days, the significant wage premium autoworkers once enjoyed over the average American worker has been almost completely eliminated, Labor Department data show.

Employees who work in motor vehicles and parts manufacturing used to earn more than 30 percent above what all private U.S. nonsupervisory workers made in 2006. That was down to just 1.8 percent in October, the lowest premium in Labor Department data going back to 1990. At $21.56 an hour, the average hourly wage for autoworkers now is actually lower than it was 10 years ago at $22.51, according to data that haven't been adjusted for inflation.

With their employers back on their feet, workers entered negotiations that began in July focused on getting a piece of the industry's recovery and making up for years of frozen or reduced earnings.

An acceleration in wage growth has been a persistently missing piece of the economic recovery and one that's been lamented by Fed policy makers debating the timing of their first interest-rate increase since 2006 and the pace of rises thereafter. The autoworker agreements and their potential to ripple through the economy may help provide Fed officials with an extra bit of confidence that wage inflation pressures are building.

Spread the word